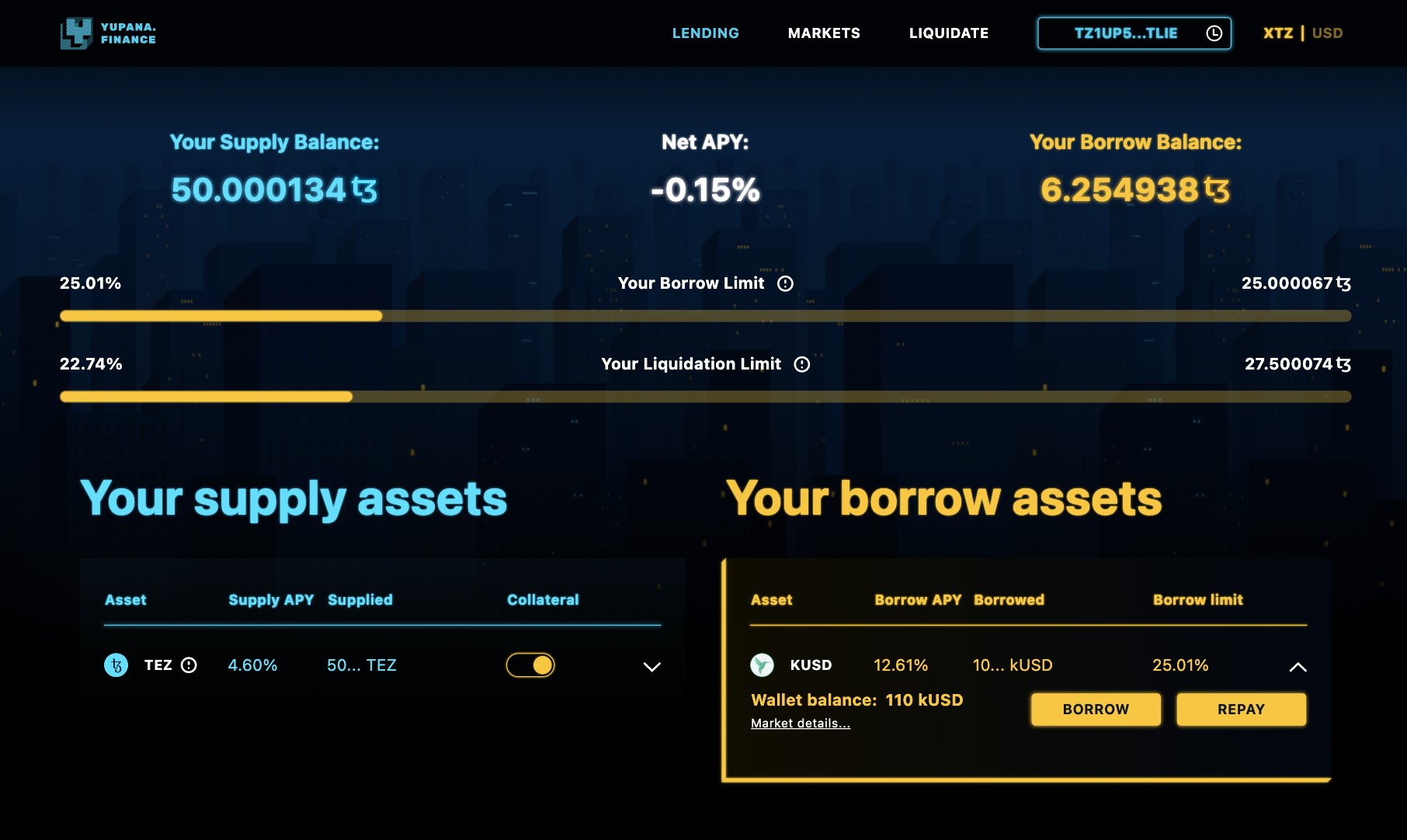

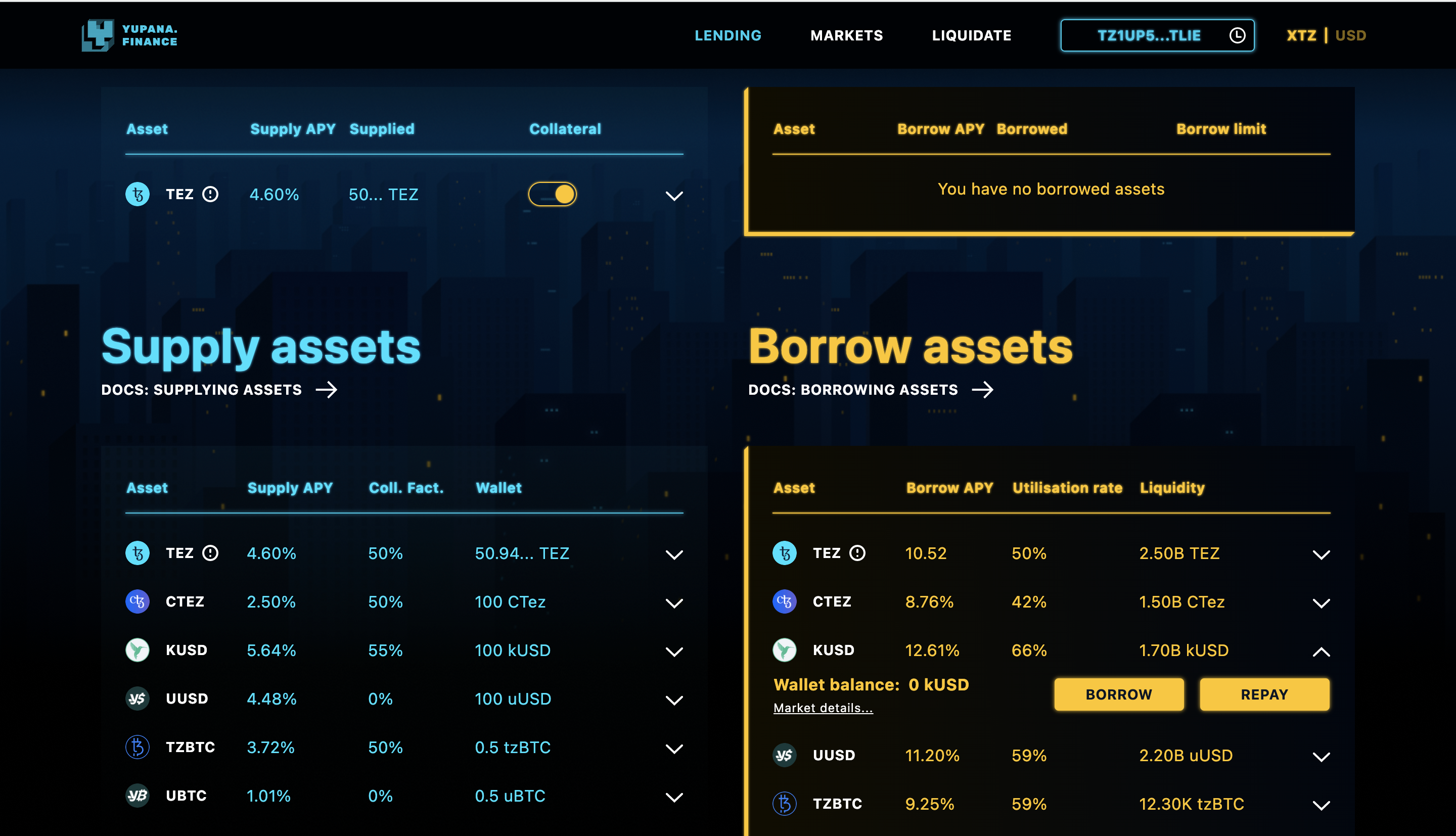

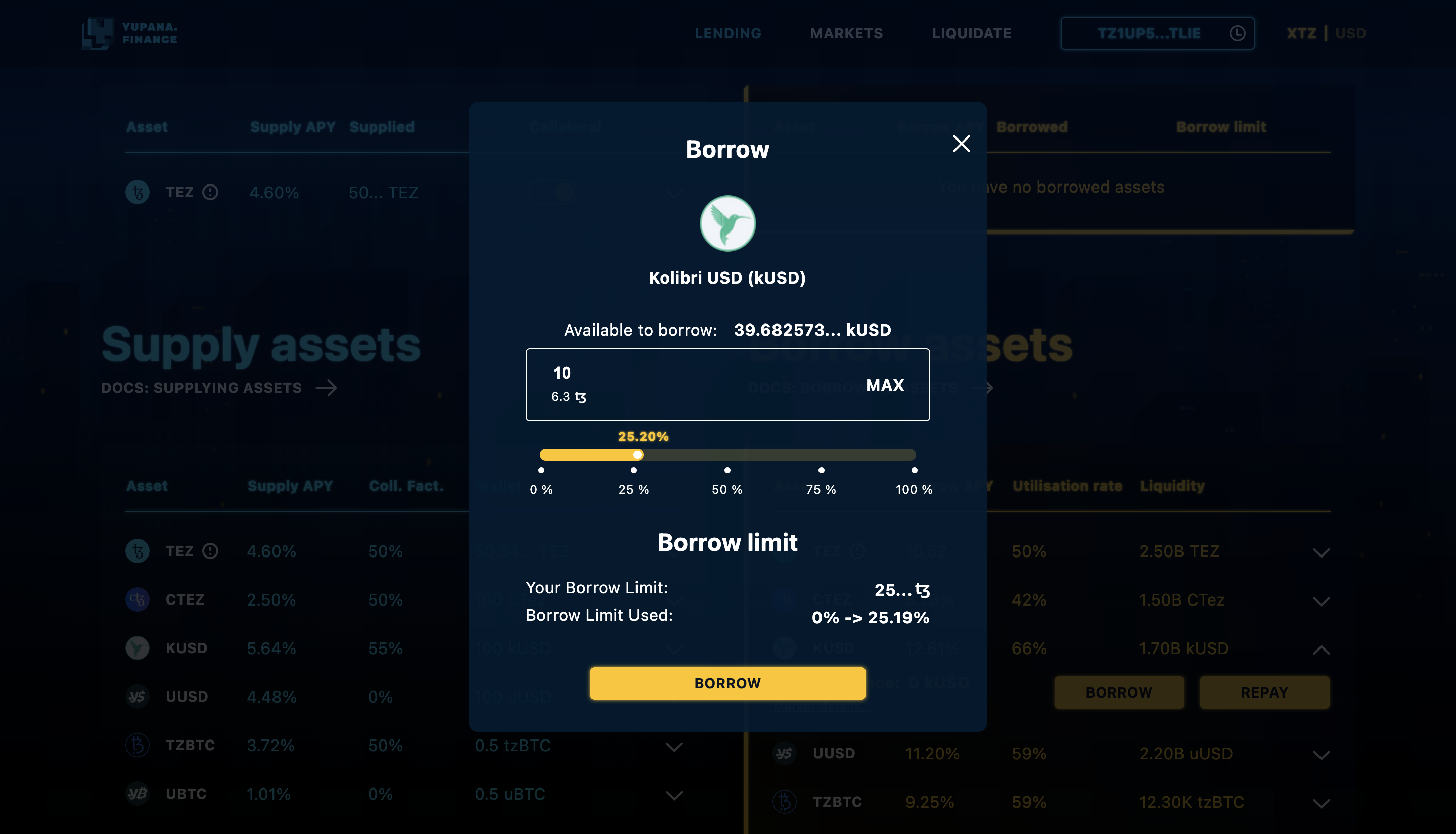

Borrowers can directly take a secured loan through the Yupana protocol as P2P lending. To get a loan, the borrower needs to supply assets as collateral more valuable than the loan amount. Collateral rates are specific to each asset.

Watch the full video:

The size of the available loan depends not only on the size of your collateral but several other variables, like current liquidity in the pool and your health factor.

Borrowing happens in the Borrow Assets section. But only once you have set collateral. Learn how to set collateral here.

The interest rate on a loan depends on a specific asset and is determined by the ratio of supply and demand for the asset. The current interest rates on your active loans can be checked in the Borrowings tab of your dashboard.

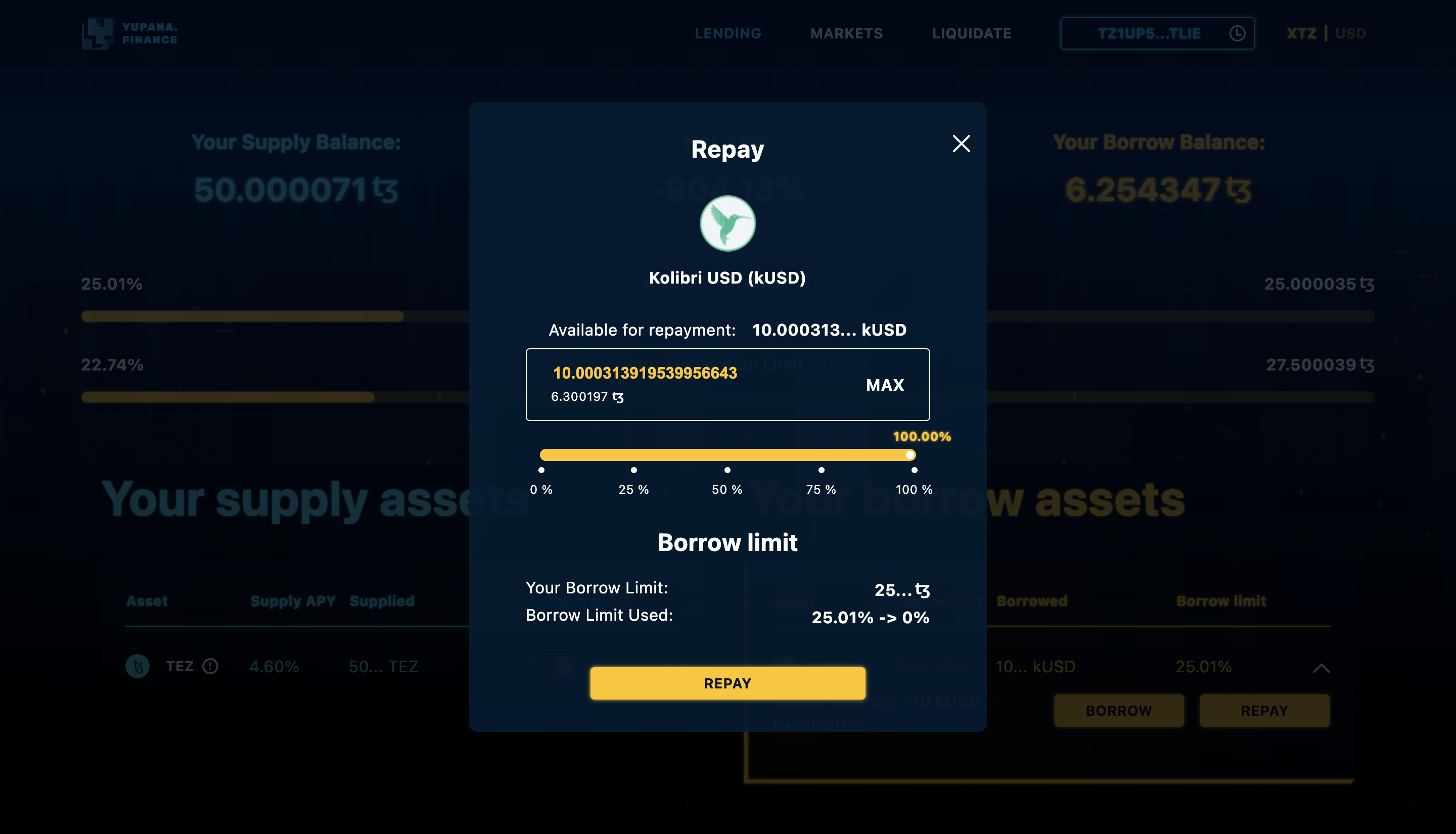

Loans have no time limit but rising percentages and exchange rate volatility may change your supply/debt ratio. As a result, your health factor may deteriorate, leading to the eventual liquidation. To avoid liquidating your collateral, you need to keep an eye on your health factor. To increase it, you can partially repay the loan or replenish more assets as your collateral.

To repay the loan enter Your Borrowed Assets tab.