Video tutorial:

Text tutorials:

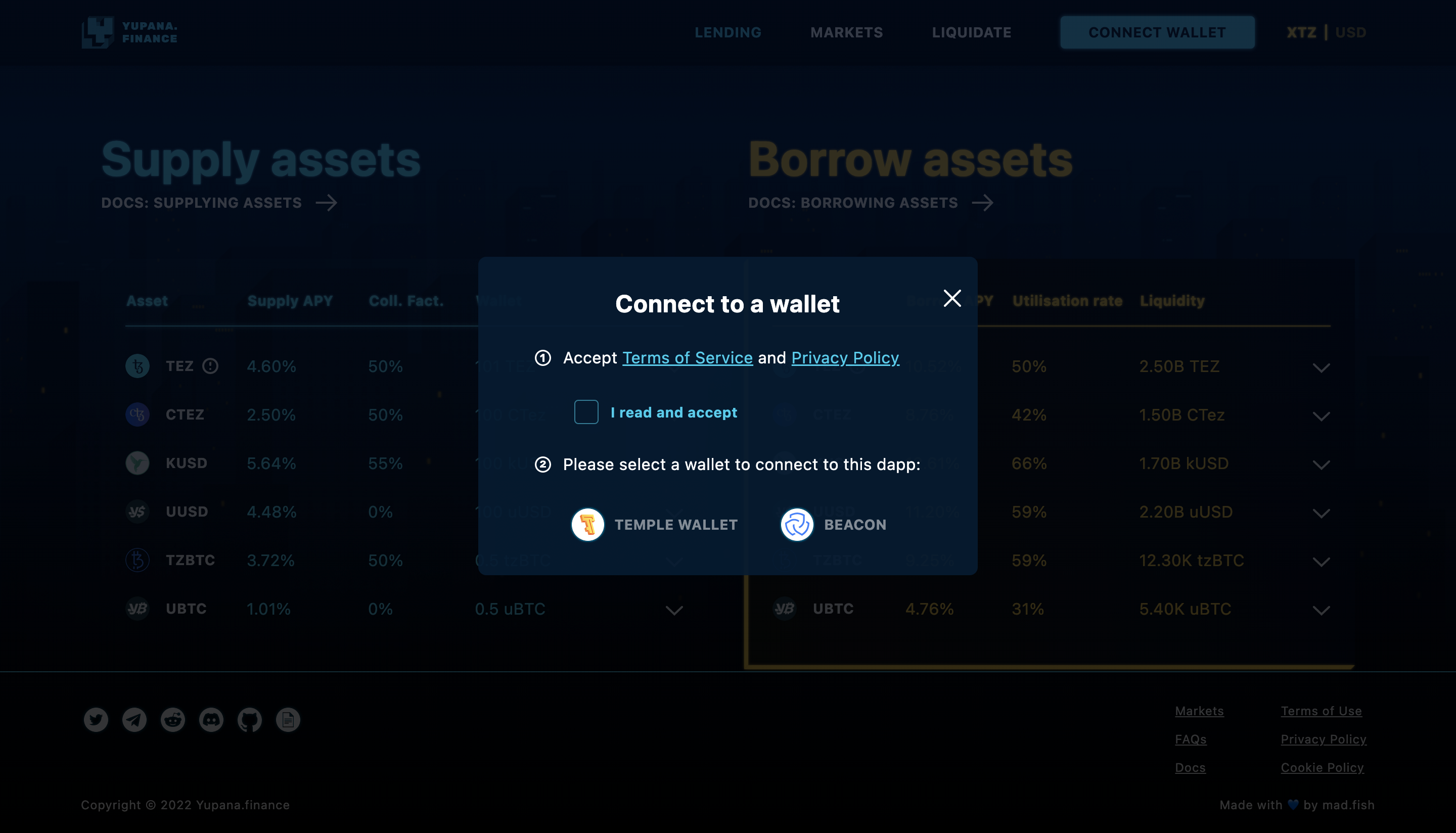

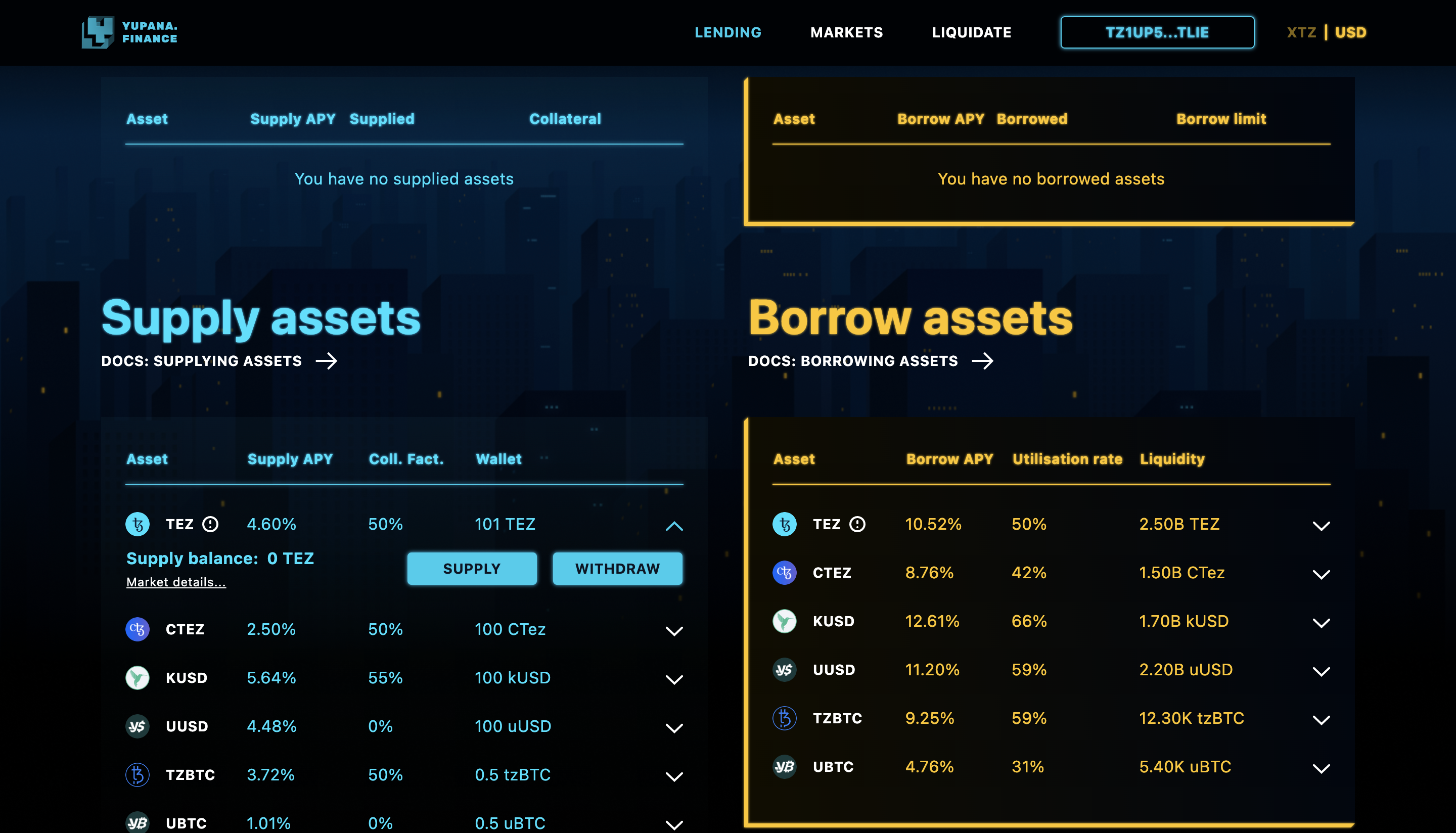

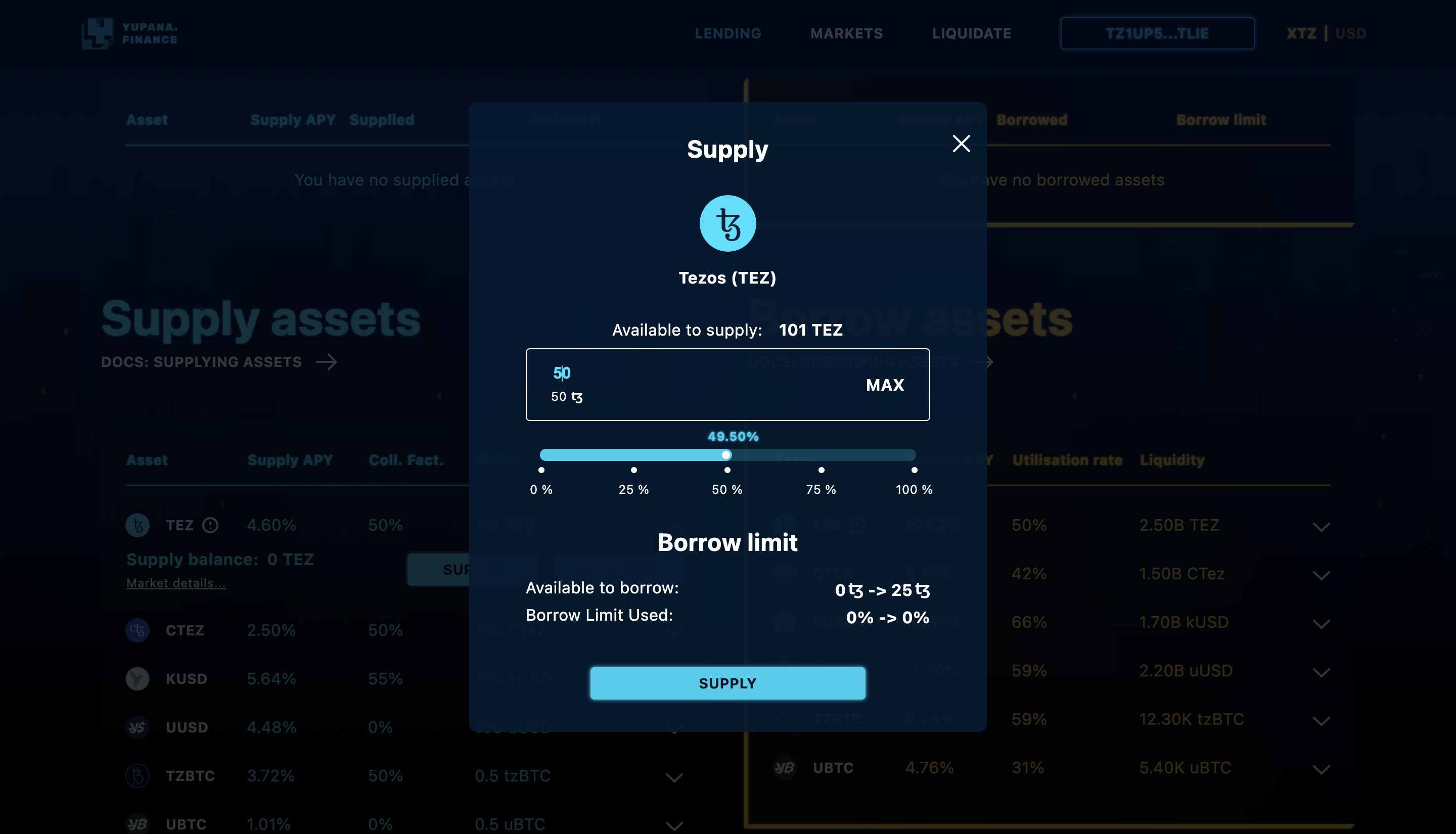

Making a deposit is not much different from locking assets in most other DeFi protocols.

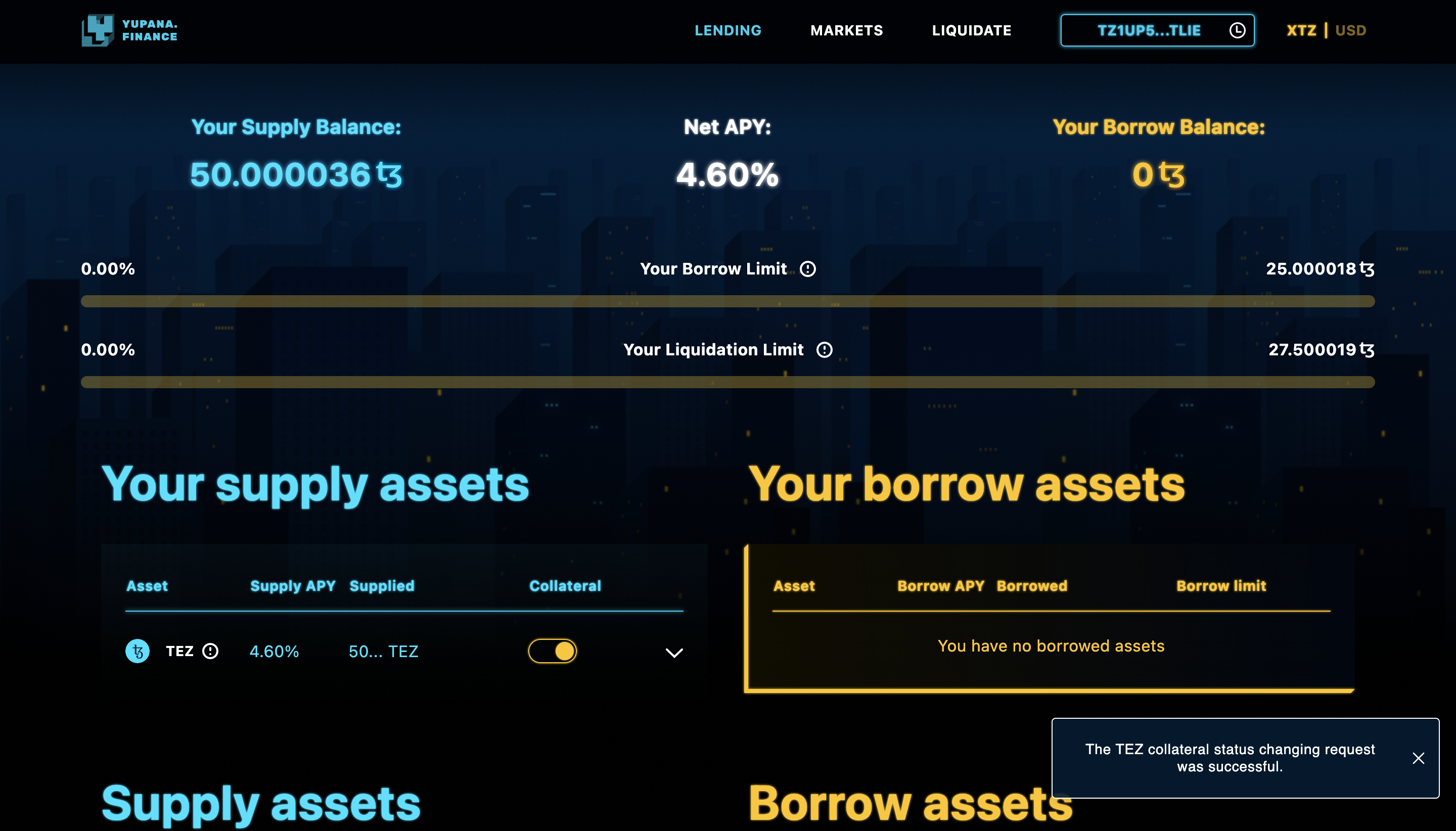

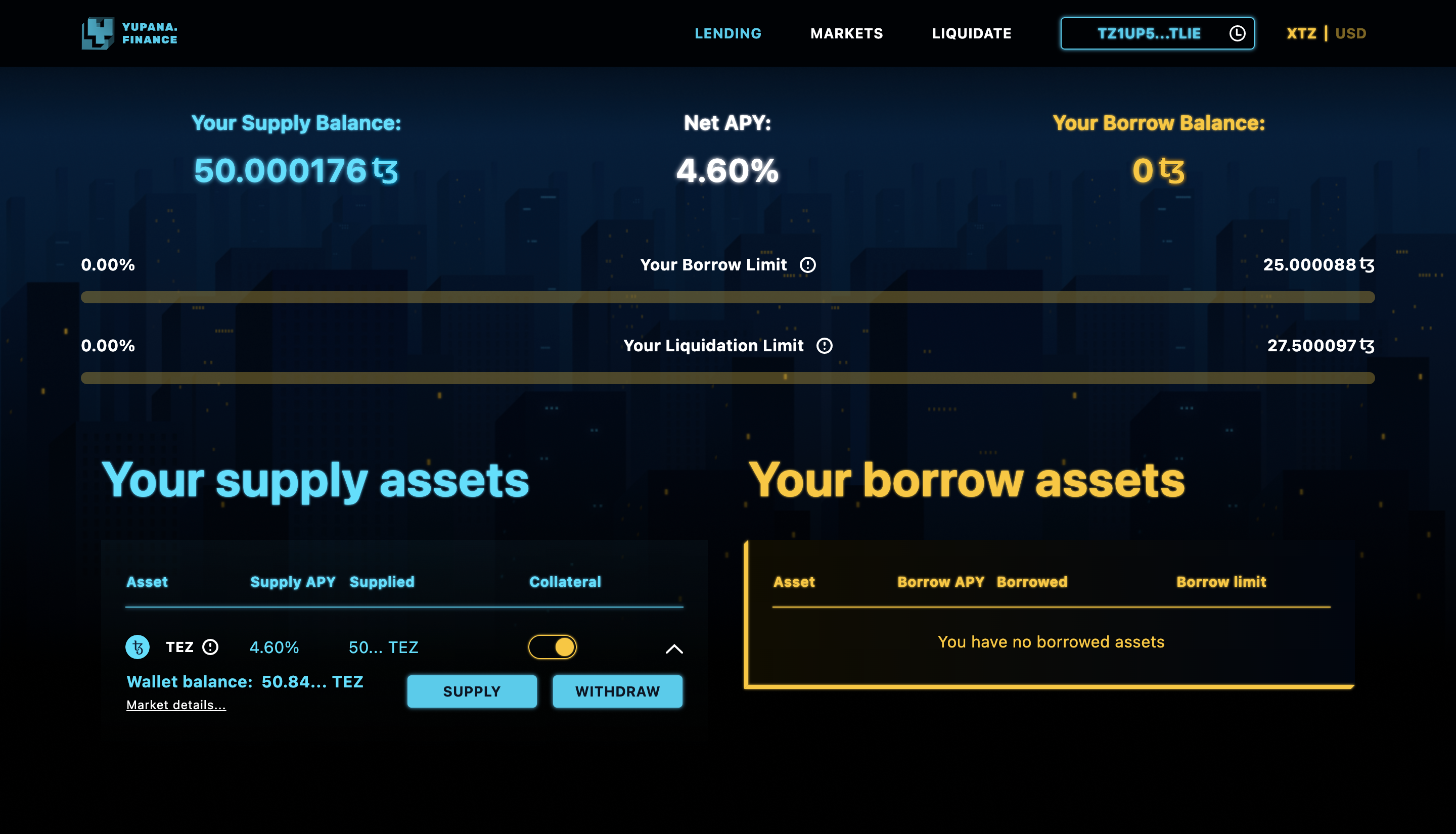

As the lender supplies an asset, borrowers can pick the asset up and start paying the interest on their debt. Some of that interest is funneled to the Yupana reserve fund but most of it is distributed to the suppliers starting from the first block. The interest paid to the supplier is added to his deposit’s body and can be collected as he withdraws the deposit.

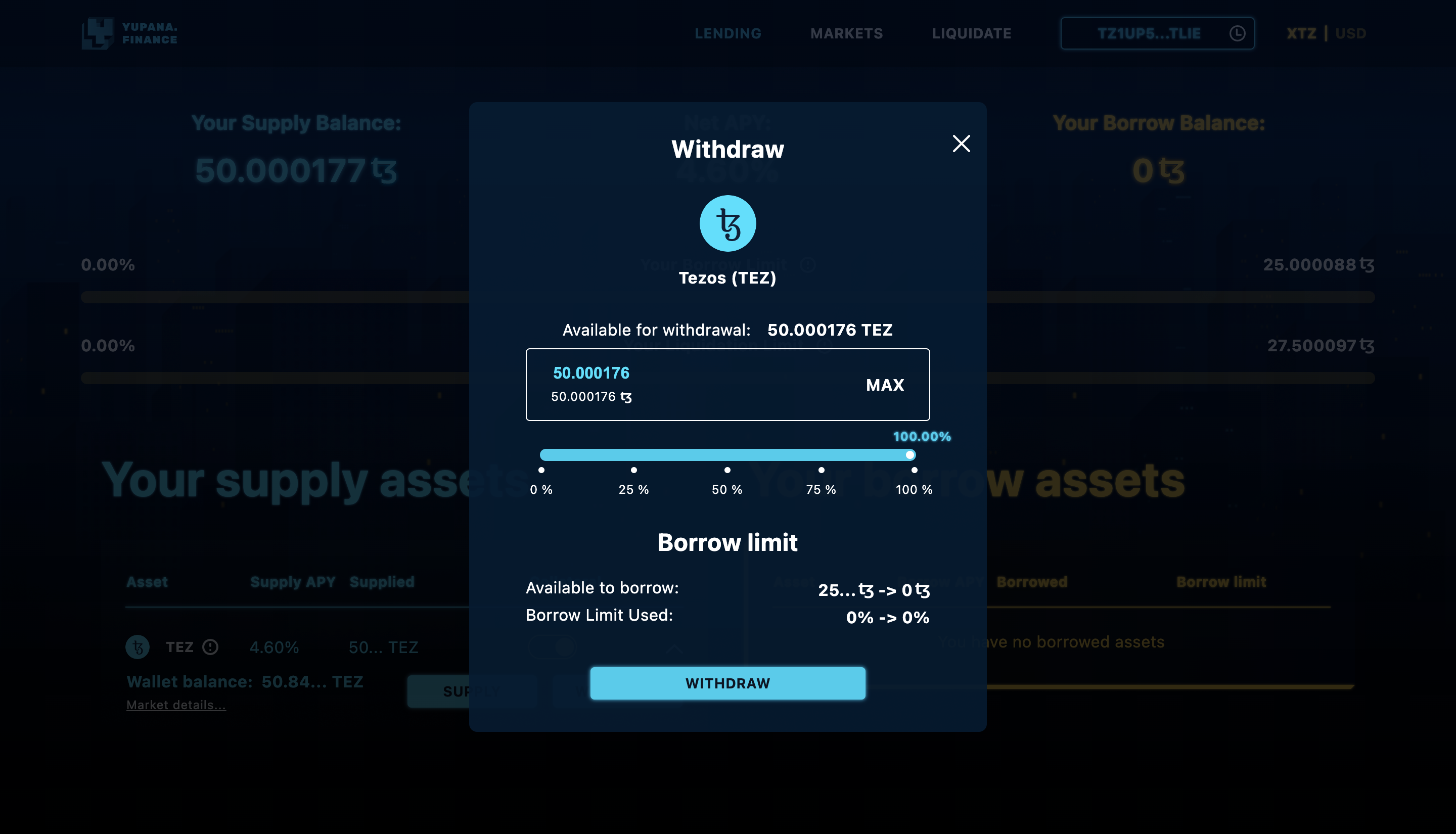

The deposit can be withdrawn at any time unless it is already used as collateral.

The lender’s deposit may also serve as collateral (togglable), which allows borrowing assets from other users of the protocol at an interest. Thus lenders and borrowers can seamlessly assume both roles.