Yupana.Finance is an open-source, decentralized, and non-custodial lending protocol on Tezos.

What is a DeFi lending protocol?

DeFi lending protocols are trustless platforms fueled by smart contracts that serve two main purposes: lending and borrowing cryptocurrency without an intermediary.

How does the platform work?

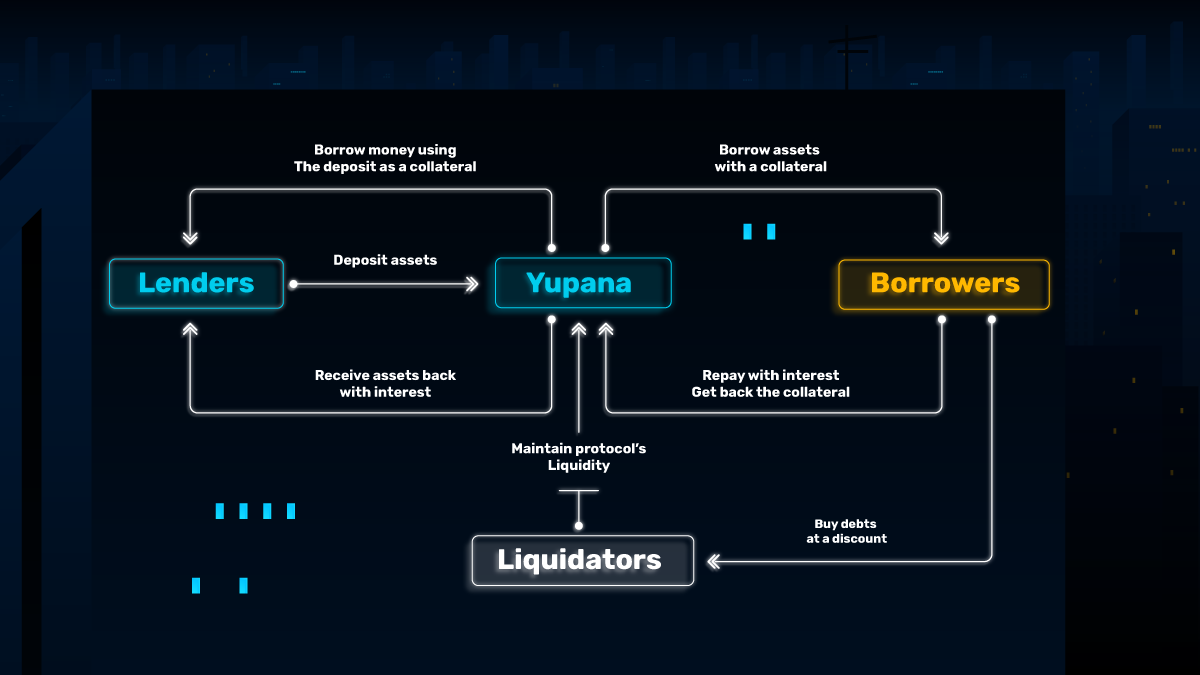

Lenders provide liquidity to the protocol, receiving passive income, while borrowers take overcollateralized loans. The third group named Liquidators is incentivized to liquidate positions with insufficient collateral and keep the platform running.

Lending assets to others is beneficial in a classic way: lenders accrue interest on their deposits with tangibly decreased risks. Putting one’s assets to work, for example, in a liquidity pool is always haunted by possible pool depletion and impermanent loss. But when you lend, you always get your exact deposit back.

As Lenders supply their assets to the lending pool, they receive an equivalent amount of yTokens (Yupana liquidity shares). yTokens can be transferred as long as they are not used as collateral on the platform (lenders can also take loans using their deposits as collateral).

At the same time, borrowing assets is a go-to tool for traders and DeFi enthusiasts.

Bulls love borrowing assets because swapping an asset is for all purposes the same as closing a long position and losing potential future profit. In lending protocols, users may borrow liquidity, without selling their assets, and use the borrowed funds in other DeFi projects. Thus, expanding their financial activities without selling any assets.

Bears play their own fun, albeit risky, game of shorting. Borrowing an asset they expect to drop, selling it immediately, and then re-buying at a lower price later is the closest thing to conjuring money out of thin air.

It is wise to remember that there is always a risk of liquidation if the loan is neglected or the market becomes dangerously volatile.

Finally, we arrive at the third activity favored by some DeFi mavericks: liquidation.

Liquidators help to maintain liquidity on the protocol by buying out other users’ debts at a discount. In other words, they close debt positions of borrowers when collateral value is no longer properly covering their loan/debt value.